RBI MPC Meeting Highlights

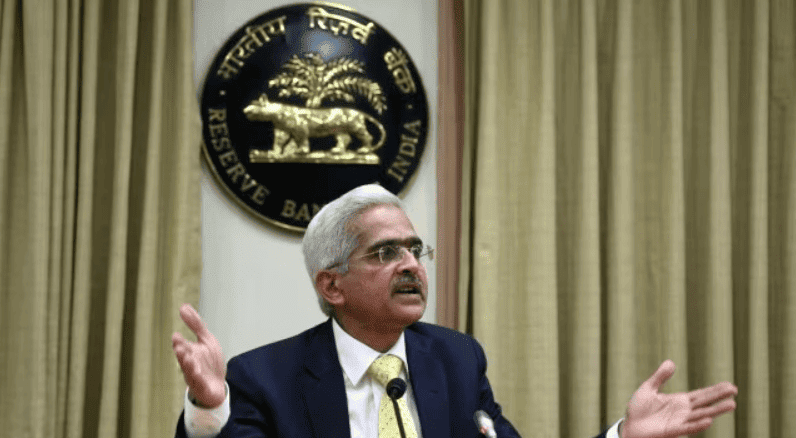

The benchmark lending rate or the repo rate will remain unchanged at 6.5 percent, Reserve Bank of India (RBI) Governor Shaktikanta Das announced on December 8, following the conclusion of the three-day meeting of the central bank’s Monetary Policy Committee (MPC).

RBI has paused the benchmark lending rates since February

The benchmark lending rate or the repo rate will remain unchanged at 6.5 percent, Reserve Bank of India (RBI) Governor Shaktikanta Das announced on December 8, following the conclusion of the three-day meeting of the central bank’s Monetary Policy Committee (MPC).

“MPC voted unanimously to leave the repo rate unchanged at 6.5 percent,” RBI Governor Shaktikanta Das said, adding that Standing Deposit Facility and Marginal Standing Facility rates have also been left unchanged at 6.25 percent and 6.75 percent, respectively.

“MPC also voted, by 5 votes to 1, to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns to the target, while supporting growth,” he noted.

Here are the key highlights from RBI’s announcements:

CPI inflation forecast for FY24 retained at 5.4%

The consumer price index-based inflation forecast for entire fiscal year 2023-24 has been retained at 5.4 percent, Das said. Here is the quarter-wise projection shared by him:

-

- October-December 2023 retained at 5.6 percent.

-

- January-March 2024 retained at 5.2 percent.

-

- April-June 2024 retained at 5.2 percent.

-

- July-September 2024 pegged at 4.0 percent.

-

- October-December 2024 pegged at 4.7 percent.

Uptick in November inflation likely

“There has been broad based easing in core inflation, which shows the effect of monetary policy. But inflation will likely tick up in November and that needs to be monitored for second round effects, if any,” Das said.

“Notwithstanding the progress made on lowering inflation, the 4 percent target is yet to be reached and we have to stay the course,” he added.

GDP growth forecast for FY24 raised to 7%

GDP growth forecast for FY24 has been raised to 7 percent from 6.5 percent, Das announced during the press briefing. Here’s the quarter-wise forecast:

-

- For the October-December 2023 quarter, the growth projection has been raised to 6.5 percent from 6.0 percent.

-

- For January-March 2024 quarter, it has been raised to 6 percent from 5.7 percent.

-

- For April-June 2024, the forecast has been raised to 6.7 percent from 6.6 percent.

-

- In July-September 2024, the GDP growth is seen at 6.5 percent.

-

- GDP growth forecast in October-December 2024 is seen at 6.4 percent.

Regulating digital lending

Commenting on the measures taken to curb retail loan growth, Das said, “We do not wait for the house to catch fire and then act”.

“We will come out with a unified regulatory framework on connected lending for all regulated entities of the Reserve Bank. This will further strengthen pricing and management of credit by regulated entities,” he added.

The RBI Governor also noted that a regulatory framework would be laid down on web aggregation of loan products. This is expected to enhance transparence in digital lending, he said.

Also Read : Will RBI follow up on November action on personal loans?

UPI limit enhanced for hospital, educational payments

The UPI limit for payments to hospitals and educational institutions now stands revised upwards from Rs 1 lakh to Rs 5 lakh per transaction, Das announced.

Cloud facility soon for financial sector

The RBI is working on establishing a cloud facility for the financial sector in India, Das said, noting that banks and financial institutions are maintaining an ever-increasing volume of data.

“This will enhance data security, integrity, and privacy. It is intended to be rolled out in a calibrated manger over the medium term,” he said.

Fintech repository by April

“We propose to set up a FinTech repository by April 2024. We encourage FinTechs to provide relevant information voluntarily to this repository,” Das stated.

‘Normalcy still eludes global economy’

“The year 2020-2023 will go down in the history as a period of volatility, due to the black swan events seen in quick succession,” Das said.

“As 2023 comes to an end, the long-awaited normality still eludes the global economy. While headline inflation has receded from the highs of last year, it remains above target in a number of countries,” he added.

Ahead of the MPC announcement, economists expected the panel to maintain status quo at a time when concerns over high interest rates impacting economic growth have tapered with the second quarter GDP growth coming in at a robust 7.6 percent.

Even though inflation has tapered and concerns over core inflation eased, the volatility in food prices was expected to weigh on the MPC’s decision.

Notably, the RBI began increasing the benchmark lending rates in May 2022, following the post-Covid pandemic turbulence seen by the global economy and the uncertainty caused due to the Russia-Ukraine war. After raising the interest rates by 250 basis points till February 2023, the central bank struck a pause and kept the benchmark lending rate steady at 6.5 percent.