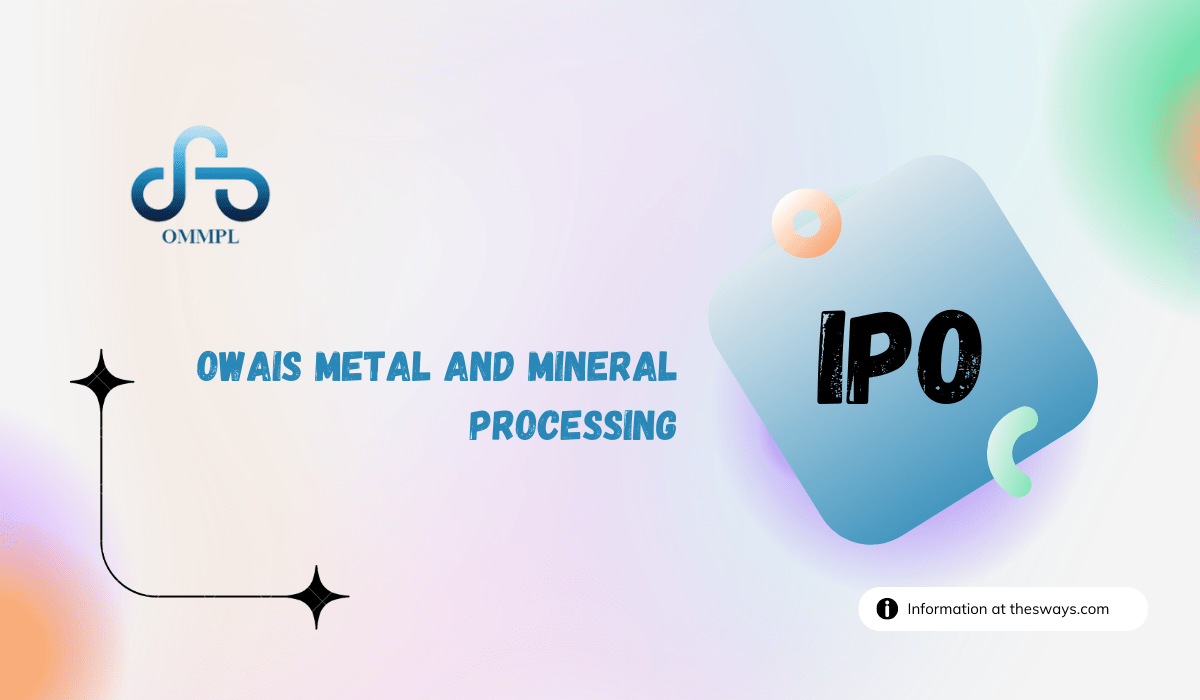

Owais Metal and Mineral Processing IPO opens for subscription on February 26, 2024 and closes on February 28, 2024.

Owais Metal and Mineral Processing IPO is a book built issue of Rs 42.69 crores. The issue is entirely a fresh issue of 49.07 lakh shares.

The allotment for the Owais Metal and Mineral Processing IPO is expected to be finalized on Thursday, February 29, 2024. IPO will list on NSE SME with tentative listing date fixed as Monday, March 4, 2024.

IPO price band is set at ₹83 to ₹87 per share. The minimum lot size for an application is 1600 Shares. The minimum amount of investment required by retail investors is ₹139,200. The minimum lot size investment for HNI is 2 lots (3,200 shares) amounting to ₹278,400.

Gretex Corporate Services Limited is the book running lead manager of the IPO, while Bigshare Services Pvt Ltd is the registrar for the issue. The market maker for IPO is Gretex Share Broking.

About Owais Metal and Mineral Processing Limited

Owais Metal and Mineral Processing Limited was established in 2022 and is engaged in the production and processing of metals and minerals. Prior to the incorporation of the company, the business of the company was carried on under the name of M/s Owais Ali Overseas, a sole proprietorship firm of the promoter Mr. Saiyyed Owais Ali.

The company is engaged in the manufacturing and processing of the following products

- Manganese oxide (MNO): It is used in the fertilizer industry and manganese sulphate plants

- MC Ferro Manganese: used in the steel and casting industry

- Charcoal production: used in furnaces in industries that require high heat for their manufacturing process, e.g. the steel industry

- Processing of minerals such as ferroalloys, quartz, and manganese ore: used in the hotel industry, the tile and ceramics industry, the glass industry, and the interior design and furniture industry.

The company supplies its products to the states of Madhya Pradesh, Maharashtra, Punjab, Delhi and Gujrat.

The company’s manufacturing facility is located in Meghnagar, Madhya Pradesh. As of December 31, 2023, the company had 25 permanent employees.

Owais Metal and Mineral Processing IPO Details

| IPO Date | February 26, 2024 to February 28, 2024 |

| Listing Date | [.] |

| Face Value | ₹10 per share |

| Price Band | ₹83 to ₹87 per share |

| Lot Size | 1600 Shares |

| Total Issue Size | 4,907,200 shares (aggregating up to ₹42.69 Cr) |

| Fresh Issue | 4,907,200 shares (aggregating up to ₹42.69 Cr) |

| Issue Type | Book Built Issue IPO |

| Listing At | NSE SME |

| Share holding pre issue | 13,275,198 |

| Share holding post issue | 18,182,398 |

| Market Maker portion | 344,000 shares |

Owais Metal and Mineral Processing IPO Reservation

| Investor Category | Shares Offered |

|---|---|

| QIB Shares Offered | Not more than 50.00% of the Net offer |

| Retail Shares Offered | Not less than 35.00% of the Offer |

| NII (HNI) Shares Offered | Not less than 15.00% of the Offer |

Owais Metal and Mineral Processing IPO Timeline (Tentative Schedule)

Owais Metal and Mineral Processing IPO opens on February 26, 2024, and closes on February 28, 2024.

| IPO Open Date | Monday, February 26, 2024 |

| IPO Close Date | Wednesday, February 28, 2024 |

| Basis of Allotment | Thursday, February 29, 2024 |

| Initiation of Refunds | Friday, March 1, 2024 |

| Credit of Shares to Demat | Friday, March 1, 2024 |

| Listing Date | Monday, March 4, 2024 |

| Cut-off time for UPI mandate confirmation | 5 PM on February 28, 2024 |

Owais Metal and Mineral Processing IPO Lot Size

Investors can bid for a minimum of 1600 shares and in multiples thereof. The below table depicts the minimum and maximum investment by retail investors and HNI in terms of shares and amount.

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Retail (Min) | 1 | 1600 | ₹139,200 |

| Retail (Max) | 1 | 1600 | ₹139,200 |

| HNI (Min) | 2 | 3,200 | ₹278,400 |

Owais Metal and Mineral Processing IPO Promoter Holding

Mr. Saiyyed Owais Ali, Mr. Sayyad Akhtar Ali, and Mr. Saiyyed Murtuza Ali are the company promoters.

| Share Holding Pre Issue | 100.00% |

| Share Holding Post Issue | 73.01% |

Owais Metal and Mineral Processing Limited Financial Information (Restated)

| Period Ended | 31 Dec 2023 | 31 Mar 2023 |

| Assets | 5,164.23 | 379.62 |

| Revenue | 3,977.54 | |

| Profit After Tax | 765.47 | -12.72 |

| Net Worth | 2,122.77 | 57.28 |

| Reserves and Surplus | 795.25 | 44.28 |

| Total Borrowing | 1,350.59 | 321.29 |

| Amount in ₹ Lakhs | ||

Key Performance Indicator

The market capitalization of Owais Metal and Mineral Processing IPO is Rs 158.19 Cr.

| KPI | Values |

|---|---|

| ROE | -5.35% |

| Debt/Equity | 5.61 |

| RoNW | -22.22% |

| P/BV | 5.37 |

Owais Metal and Mineral Processing Limited Contact Details

C/o Sayyad Akhtar Ali Vahid Nagar,

Old Baipass Road NA

Ratlam – 457001

Phone: +91-9300096498

Email: info@ommpl.com

Website: http://www.ommpl.com/